- front page

- Investment and Financial Management

- invest

- Young people, why you should start investing now

Young people, why you should start investing now

dateDec 12, 2022

updateApr 06, 2022

authorFlyseed

瀏覽數:18093

Image Source:Shutterstock

If you use the wrong method to save money, not only will you not be able to save money, but the money you save will become less and less. Putting money in

Ayu is 32 years old this year. He has worked in a foreign packaging factory for 8 years. He earns 50,000 yuan a month (working night shifts). His wife earns 30,000 yuan a month. With their year-end bonuses, the family's annual income is about 1.1 million yuan. He has a 3-year-old child. He currently rents a house with no mortgage, but has a 600,000 yuan car loan. After deducting rent, car loan, nanny fees, filial piety fees, living expenses... every month, there is not much left. Looking at the rising housing prices, the idea of buying a house to settle down seems to be an unattainable dream. Maybe you don't have a rich dad, so you need to invest in financial management as soon as possible. The following are the reasons why you must start investing right away:

Inflation is eating away at your income

You think that since you can't save money with a low salary, you might as well enjoy life and pursue small happiness. You are unwilling to sacrifice the quality of life for saving money, but have you noticed? Everything you need in life, including chicken steak, coffee, bubble tea, toilet paper, etc., has quietly increased in price. Prices will not stop inflating just because you decide to become a "lying flat" person. The constantly rising prices are eating up the quality of life that you thought would not change. You must start investing in financial management to resist inflation.

Avoid becoming a dirty old man

As the population continues to age, young people are reluctant to have children, the elderly are living longer and longer, and social welfare conditions are getting worse, don't think that the dilemma of living on the streets and receiving social assistance will not happen to you. The National Development Council estimates that by 2040, on average, every two young and middle-aged people will have to support one elderly person or child. In the past, a father could support a family by working alone. Now, let alone supporting a family, he can hardly even support himself. When you get old and gradually lose your ability to work, an unexpected change will turn you into a "low-class old man." Investing can allow you to retain assets, stay away from low-class old people, and not become a burden on society."Shirakawa elderly" is a new term that has appeared in Japan. "Shirakawa elderly" refers to elderly people living a lower-class life.

There are people who want to buy a house

If you have not been scared to death by the housing prices and have not given up the idea of buying a house, then you should start investing immediately, set up a simple and achievable investment plan, and execute the investment in a long-term and disciplined manner. For those who are willing to invest, buying a house is not an unattainable dream, it just takes time to accumulate. However, for those who love to complain, blame everything, and talk but do not practice, it is indeed a fantasy. Buffett’s famous saying: "Investing is like rolling a snowball. Find a path with wet snow and a long slope, and the snowball will roll bigger and bigger." The greatest asset of young people is time. The earlier you start, the more chances you have to make a profit.Buffett famously said: "Investing is like rolling a snowball. If you find a path with wet snow and a long slope, the snowball will roll bigger and bigger."

People who want to achieve financial freedom

What is financial freedom? It is the FIRE (Financial Independence Retire Early) that has become popular in recent years. Financial freedom means "having enough money to use without working". Early retirement does not mean not working, but not having to work for money and being able to do "what you want to do". If the salaried class wants to achieve financial freedom, you must invest in financial management. This does not mean that you have to start a business and become Terry Gou or Morris Chang, but that you have to understand financial knowledge, accumulate assets through investment knowledge, and achieve your financial freedom (FIRE) through passive income.FIRE (Financial Independence Retire Early) means "Financial Independence, Retire Early"

The risk is highest when you do nothing

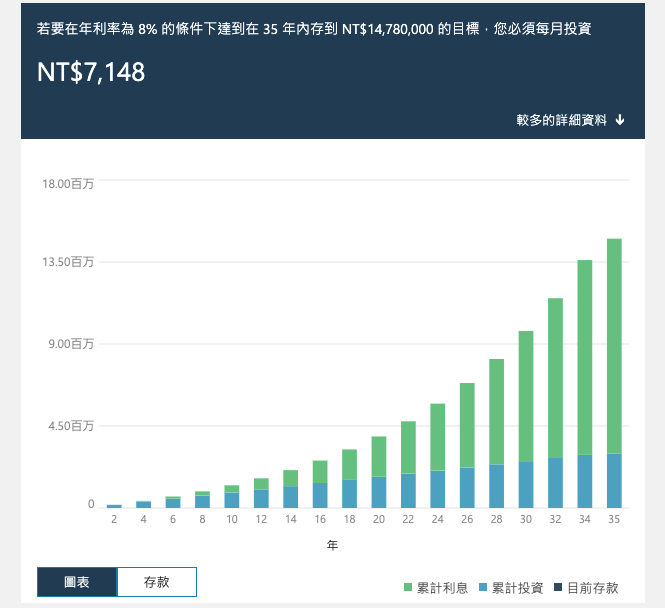

Our parents often tell us that venture capital investment is very dangerous and that there is a risk of losing everything. They use their own failed experiences to advise you not to invest in a startup lightly and to just work hard. As a result, you only dare to put your money in bank deposits and buy savings insurance. At the age when you should be investing, you do nothing or make wrong decisions. At first glance, there seems to be no loss, but in fact, doing nothing is the riskiest time, because your 1 million (no more investment) will be 14.78 million in 35 years (calculated at 8% compound interest). If you do nothing, the 1 million will still be 1 million, and the purchasing power of 1 million may only be 800,000 due to price inflation.It is not difficult to make an 8% long-term investment. Taking Yuanta ETF 0050 as an example, the annualized return rate over 15 years is about 8% - 11%.Note: Past performance is not indicative of future performance.

If you save 7,148 yuan per month, you can still reach 14.8 million yuan in 35 years.

Image: msn Finance

in conclusion

You helplessly use "lying down" as a silent protest against the world's ruthless treatment, but can lying down really change anything? Nothing can be changed. If you are tired, just lie down and take a rest, but please don't lie down all the time, because doing nothing is the highest risk. If you want to be happier in the future, have more money, buy a house, have money to do what you want, and don't want to become a burden on society and live the life of a lowly old man, then from now on, please make some changes and start trying to save money for investment, even a few thousand yuan a month is fine. Please let time become the biggest weapon for accumulating assets. This is not a simple thing, but it is never too late as long as you start.This article states:

The author has no vested interest in any transaction with Yuanta Securities. The content of this article is only the author’s personal opinion. Please think independently and make careful assessments before investing, and be solely responsible for any subsequent gains or losses of any investment.

(The copyright of this article belongs to Darrick. Reprinting of pictures and texts without authorization is prohibited)